Core Lithium Ltd (ASX: CXO)

Definitive Feasibility Study: The DFS results demonstrate a robust project with some enviable characteristics: simple flow chart, low capex, low capital intensity, low operating costs, quality product and proximity to port and markets, resulting in an excellent NPV/capex ratio.

Financing: The completion of the DFS opens the path to financing which is likely to be predominantly a combination of debt project finance from mining banks, prepayment or other financing arrangements linked to product off-take and possibly some low-cost debt finance from government agencies. We have assumed a debt funding of A$80 million.

Permitting: CXO has already secured Mining Leases and environmental approvals to allow for an orderly start of the project.

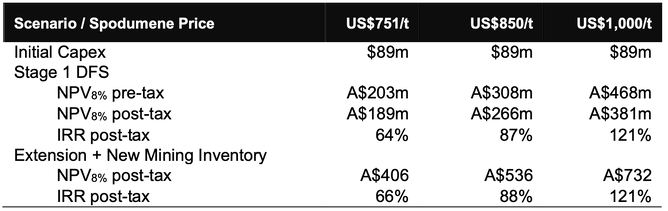

Finniss Project Valuation: We have run the Stage 1 DFS scenario as well as an extended scenario (18 years mine life ) assuming the conversion of a portion of the Exploration Target to additional mining inventory.

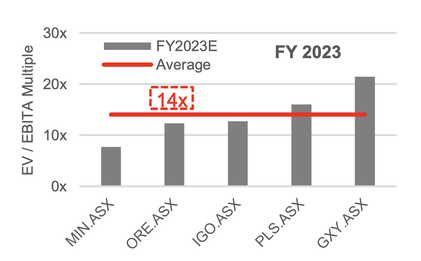

CXO Valuation: Our sum of the parts valuation assumes an equity capital raising of $25 million @ $0.23 to complement the debt and to derive a price target of $0.44, fully funded. Once the Finniss has reached commercial production, CXO valuation could increase further considering an EV/EBITDA multiple of 10x FY2023E (average of ASX peers is 14x) resulting in a market value of $1 billion and a share price of $0.78.

News flow: We anticipate several share price catalysts including financing and off-take deals, leading to final investment decision and start of construction before year-end.

Spodumene pricing: among the lithium products, spodumene is currently closing the gap with value-added lithium chemicals. Contract prices have increased from US$500/t in April to more than US$650/t currently with the spot price reaching US$925/t (FOB Australia). The last time the spodumene price reached such level (late 2017 - early 2018), lithium chemicals were US$22,000-24,000/t, they are only US$12,000/t to US$14,000/t currently.

Investment Perspective: Mining is cyclical and timing is critical. After experiencing multiple successive boom and bust cycles, CXO appears very well positioned to benefit from a stronger and longer lithium market cycle as the EV market growth is accelerating on a global scale and will reach mass production level and adoption within the next five years.