We initiate coverage of Melbana Energy Limited (ASX: MAY) with a Speculative Buy rating and positive outlook for the future. MAY has been stalwart in its dedication to Cuba, entering negotiations in 2013 with Block 9 PSC awarded in September 2015.

Cuba is open for business and in need of more production. Currently the country, primarily through its national oil company, CUPET, produces approximately 36,000 barrels of oil per day and ~32 billion cubic feet of gas. Oil production meets just 24% of the domestic consumption, with the balance satisfied by imports.

Upcoming drilling of Amistad, Alameda and Marti Reservoir in Block 9 Cuba: As a direct follow-up of the successful Alameda-1 well MAY is in preparations for two appraisal wells; Alameda-2 & Alameda-3, which are expected to start drilling in June 2023. Alameda-2 will evaluate the hydrocarbons encountered in the Amistad units of the Upper Sheet with Alameda-3 to evaluate the lower two reservoirs (Alameda and Marti). Melbana’s drilling contractor, a subsidiary of Sherritt International has decades of experience in Cuba drilling and producing hundreds of oil and gas wells over the past 25 years.

Block 9 had multiple other producing fields within close proximity and the Motembo field, a working oil system that produced a high-quality light crude (up to 64.5o API oil). The volumes of the Amistad structure have been independently estimated as 1.9 billion barrels of Oil in Place (OIP) and 88 million barrels of Prospective Resource (un-risked gross best estimate). Total volumes, with reservoirs Marti and Alamada, come to 6.4 billion OIP and 362 mmbbl of Prospective Resource.

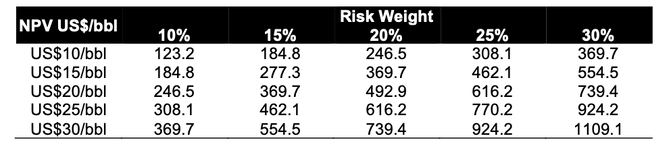

CUBA Block 9 PSC Project Valuation: using various Brent prices & Risk Weights.

If the wells are successful: To fully evaluate the different reservoirs properly, it is necessary to drill two separate wells to both test each whilst also retaining the flexibility to allow simultaneous production from more than one reservoir. Melbana has designed the drilling program to leave any of these reservoirs on production if the results of the appraisal program are supportive. Following a successful appraisal an oil field would be able to be developed quickly and cheaply due to the proximity of Block 9 to existing oil field infrastructure.

Fantastic farm out partner and deal: Farm out to Sonangol underpinned first 2 well drilling program. In December 2019, Melbana entered into a binding Heads of Agreement (“HOA”) with Sonangol, the National Oil Company of Angola & Africa’s second largest oil producer – for that entity to acquire a 70% interest in Block 9 in return it for funding 85% of the cost of two exploration wells and repaying Melbana’s past costs. The HOA was replaced with a more detailed Farm-in Agreement in May 2020. The participating interests in Block 9 PSC are Melbana 30% and Sonangol 70%. For the first two exploration wells (now completed), Sonangol paid Melbana a promote (as well as back costs) that made Melbana’s working interest 15% for those two wells only.

News flow: the key catalysts in the short and medium term is the run up to drilling and upcoming results from the wells. Some news with regards to Australia can be expected too given its trailing interest in the results of a well to be drilled in WA-488-P and the prospectivity of its other acreage positions.

MAY valuation: our sum of the parts valuation considers a 25% (or 75% risk discount) of the Cuba PSC 9 NPV estimated using an oil NPV price of US$25/bbl with a valuation of A$616.2 million or $0.18 per share. Factoring the other acreage and volumes held by MAY we assume a 90%-95% risk discount and an oil NPV price of US$10/bbl. Our total sum of parts valuation of MAY comes to $711.7 Million or $0.21 per share.