Projects Portfolio: Mayur Resources’ strategy aims to deliver shareholder value while becoming a significant partner in the nation building of Papua New Guinea (PNG). The portfolio consists of the Central Cement and Lime (CCL) project, the Orokolo Bay magnetite and mineral sands project and three renewable projects. Mayur has prioritised coastal regions for ease of development and future access to sea borne markets. As well as reducing material imports and developing export revenues, the various projects provide job and wealth creation, diversification and alternative revenues to the PNG Government outside the major gold and LNG projects. Government Support: the strategy is well supported by the State and Provincial Governments as well as landowners with all the advanced projects fully permitted, with mining licence and environmental approvals in place. Note the Government Forum taking place in May 2023 should discuss the allocation of royalties and work to local businesses during the construction and operation.

Central Lime (CLP) Project: This is phase one of the Central Cement & Lime project (excluding Clinker & Cement) the project is ideally placed geographically to service growing demand in the South-East Asia (SEA) and Pacific regions. The project also benefits from its location in a Special Economic Zone with a 10-year tax holiday.

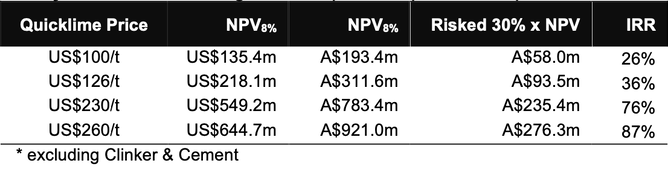

Lime Products Market: Demand for Lime in SEA and Oceania is expected to grow rapidly over the next few years, specifically driven by increased processing capacity of nickel and bauxite in Indonesia; Indonesian demand for Lime forecast to grow at a 14.6% CAGR to 2030. Global demand for Lime is also expected to grow, driven by a projected increase in steel production output and increased demand from non-ferrous metals processing – which have important applications in the energy transition. Prices have already reflected this demand pressure, with export quicklime prices reaching US$126/t FOB in 2022, compared to US$100/t assumed by MRL in its development studies. Further price upside in the range of $230/t to $260/t have also been reported elsewhere.

CCL Project Valuation*: using different quicklime price assumptions:

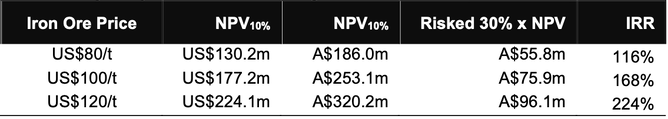

Orokolo Bay Magnetite and Industrial Minerals Project: the project already benefits from a binding off-take agreement with a Chinese specialist pellet manufacturer and a terms sheet with a leading Japanese trading house.

Orokolo Bay Project Valuation: using different iron ore price assumptions:

Renewables: beyond being attractive as standalone projects, the combination of the renewable projects (carbon offsets, solar farm and geothermal energy) with the industrial projects makes them more attractive to both financiers and off-takers. Board and Management: Mayur have assembled both on its Board and as advisors a strong mix of commercial, project development and operational skills. Mayur has been successful in cherry picking the Lime industries top executives for its CPL advisory Board.

News flow: the key catalysts in the short and medium terms are the releases of funding structures for both the CLPL and Orokolo Bay projects followed construction updates. MRL valuation: our sum of the parts valuation is supported by the NPV of the two most advanced projects. For current projects, a 70% discount risk factor or 30%xNPV has been applied to reflect the pre-funding stage and for the clinker/cement expansion case a 10%xNPV (90% discount) risk factor applied. The valuation includes a capital raising of $5 million for working capital to derive a company valuation of $215 million or $0.67 per share. Beyond this valuation, we estimated an initial price target of $1.20 assuming both key projects fully funded with a mix of debt and equity.