Massive Mineral Resource: the Razorback iron ore magnetite project combines a globally significant mineral resource with enviable characteristics: 3 billion tonnes with a Davis Tube Recovery (DTR) of 15.8%, a very low strip ratio of 0.13 (with no pre-strip) and low deleterious elements (silica, alumina and phosphorus). With the addition of Ironback Hill and Muster Dam, the mineral resource amounts to 5.7 billion tonnes.

Competitive Advantages: the results of our benchmarking indicate that the Razorback project benefits from a reasonable capital intensity with the longest initial mine life among its peers. Operating costs are within the average and more importantly the profitability of the project is one of the best. From a steel manufacturing perspective, MGT’s magnetite is a high-grade product with grade in excess of 67% Fe and low impurities that is highly sought after by steelmakers to increase productivity, provide efficiencies & reduce emissions.

Development Options: the large mineral resource provides options in terms of processing plant throughput. Further to the PFS results released in July 2021 with 12.8 Mtpa to 15.5 Mtpa throughput (or 1.9 Mtpa to 2.7 Mtpa concentrate production), the Expansion Study released in Mar 2022 provided the results of staged project development scenarios from 15.5 Mtpa to 46.5 Mtpa (or 3 to 7 Mtpa concentrate production). MGT is looking to increase and optimise the initial production, with a minimum 5Mtpa capacity, to enhance project economics via economies of scale, while taking advantage of the 5.7 billion tonne mineral resource base.

SA Government Support: the Razorback project fits well with the government’s vision of becoming a leading global supplier of quality magnetite products for steelmaking.

Green Steel: as the expectation of cleaner, greener steel production becomes further embedded in the global narrative, MGT magnetite products offer a viable alternative to Direct Shipping Ores (DSO), for which most of the high- grade deposits are now significantly depleted.

Strategic Investors: a number of parties have been given access to a data room to undertake their due diligence of the Razorback project. One can expect some agreement with one or more of them during 2023.

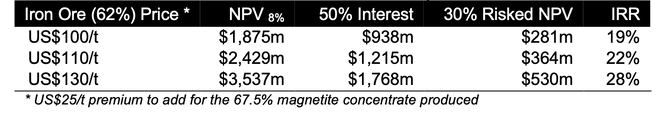

Razorback Financial Modelling: We modelled the development and operation of the project in line with the PFS (2.7 Mtpa) and Expansion Study (stages increases of production from 3 to 7 Mtpa), then used different iron ore prices. We also added an Upside scenario with another expansion to 10 Mtpa.

Razorback Valuation: based on various iron ore prices:

Funding: to assist the funding of A$1,986 million development capital expenditure (initial 3 Mtpa and expansion to 7 Mtpa in year 3), we assumed that MGT will sell 50% of the Razorback project to one or more off-takers with proceeds of $100 million.

Key Share Price Catalyst: is the announcement of one or more agreements with off-takers or project partners to assist in project development and/or funding, which will significantly de-risk the project and improve MGT’s value.

MGT Valuation: assuming an equity capital raising of A$100 million (100 million shares @ $1.00) in FY2024 to complement an initial debt of A$200m raised in the same year, we derived a valuation pre-construction of $629 million or $2.90 per share for MGT. Expansion will be financed by cash flow and additional debt. Once in operation, the project should reach its full valuation resulting in a price target of $4.50.