Technology: from a prospective graphite miner, Magnis has evolved into a technology company about to deliver innovative commercial Lithium-Ion battery (LIB) solutions to the electric vehicle and energy storage industries.

Investments and Partnerships: MNS has now strategic assets, investments and technology partnerships in vital components of the global Lithium-Ion Battery value-chain. Magnis’ technology partner, Charge CCCV (C4V) is a cutting-edge LIB technology company based in Binghamton, New York with expertise and patented discoveries in LIB composition and manufacture. MNS holds a 9.65% stake in C4V and have also licensed advanced graphite processing technology from C4V.

iM3NY: iM3NY (62% MNS, 33% C4V) is building a Gigafactory in Endicott, NY state, ramping up nameplate capacity from 1.8 GWh in 2023 to 38 GWh in 2030. We estimate that about 50% of the revenues for FY2023 have been secured by the sales’ contracts announced. Many more are at various stages of negotiation.

Competitive Advantages: cells and packs are based on an improved lithium- iron-phosphate (LFP) chemistry free of expensive and price volatile nickel and cobalt, providing more than 20% energy density than traditional LFP cells with lower cost than nickel-manganese-cobalt (NMC) cells. The cells have been commercially tested and shown to vastly extend battery life, provide greater safety, lower cost and improve charge performance addressing each of the issues of current LIBs. Manufacturing will also benefit from low-cost renewable energy below 5¢/kWh from nearby Niagara Falls hydropower station.

iM3NY Financial Modelling: capex of US$100m per GWh of additional capacity to incrementally increase nameplate capacity to 38 GWh in 2030. No allowance was made for possible funding as part of Battery Materials Processing Grants Program established by the US Department of Energy (total of US$600m p.a.). Key opex component made of 50% materials deriving a gross margin of 35-40%. Royalties (3%) and G&A (US$5m p.a.) reduce margin to a range of 30 to 35%.

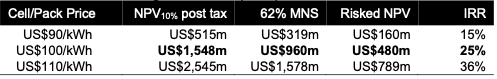

iM3NY Valuation: using various cell/pack prices:

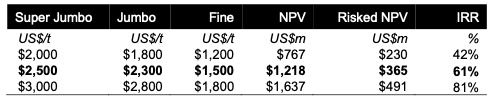

Nachu Financial Modelling: based on updated DFS results released on 27 Sep 2022, our base case NPV matches MNS US$1.2 billion. Capex of US$364m is assumed to be financed in FY2025 by an equity capital raising of A$200m and additional debt of A$500m (debt also used for iM3NY expansion). Using various graphite flake prices, the Nachu graphite project valuation stands as follows:

News Flow and Share Price Catalyst: the key driver adding shareholder value is securing further sale contracts to match as much as possible the expected ramp-up of the iM3NY Gigafactory capacity and production.

MNS valuation: Considering the above parameters, an equity capital raising of A$30m at $0.40 (75m shares) in FY2023, and subject to securing further sale contracts, our Base Case valuation stands at A$1,339m or A$1.15 per share.