Argosy Minerals Ltd

Update: thanks to surging lithium products’ prices and the construction of the 2,000 tpa lithium carbonate production operation, AGY share price has reached our valuation of $0.60 dated 14th March 2022. In parallel, AGY is now part of the ASX300 index (from 19th Sep 2022).

2,000 tpa operation: as at 1st Sep 2022, the project development works are 95% complete, with first product targeted in October. The development works continue to be on budget but experienced some slight delays.

Significantly de-risked project: through its industrial-scale pilot plant, AGY has produced 30 tonnes of battery quality lithium carbonate (>99.5% Li2CO3) over two years and sold 25 tonnes to North Asian customers.

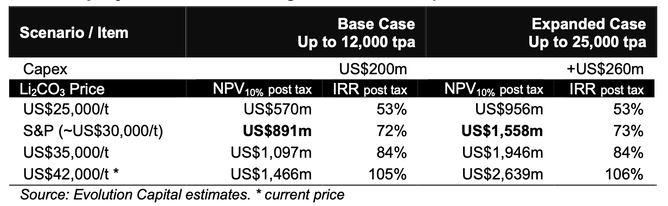

Producer status: AGY is on track to become only the second lithium carbonate producer listed on the ASX after Allkem Limited (ASX: AKE). Additional 10,000 tpa expansion: further to the PEA released November 2018, we have increased the estimated capex from US$140.9 million to US$200m and the estimated opex from US$4,645/tonne to US$8,000/tonne. The expansion is targeted to start construction in 2023.

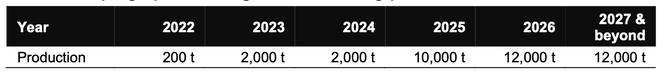

Lithium carbonate pricing: the sector has experienced a tremendous uplift in lithium product prices over the last couple of years. In parallel, inflation is back in force affecting both capex and opex (3% p.a. assumed for opex). Mineral resource: the drainable brine mineral resource estimate from the aquifer stands at 144 million cubic meters at a grade of 325 mg/L for 245,120 tonnes Li2CO3. Based on this resource, we modelled a 16-year mine life Base Case, ramping up according to the following production schedule:

Exploration target: estimates the potential for a range of up to 507,000 tonnes to 724,000 tonnes of contained lithium carbonate to a depth of 300m. On this basis, we modelled an Expanded Case with a 30-year LOM. Ownership: AGY currently has a 77.5% interest in the Rincon Lithium Project, increasing to 90% ownership upon development of the 10,000 tpa operation.

Rincon project valuation: using various Li2CO3 prices:

Tonopah lithium project: Exploration and development activities should bring considerable value given the highly strategic location 4km from Albermarle (NYSE: ALB) Silver Peak brine operation and ~300km from Nevada’s Tesla Gigafactory.

News flow: Beyond the ramp-up of the Rincon production, we see the financing of the 10,000 tpa expansion as one of the key catalysts for further share price appreciation in the medium term. AGY aims to secure most of the financing through strategic investment and prepayments linked to off-take arrangements. At this time, we have assumed a A$100m debt financing with 5-year maturity, 12% interest rate, 5 equal repayments of $25m.

AGY valuation: Considering the above parameters and an equity capital raising of A$30m at $0.60 (50m shares), our Base Case valuation stands at $1,332m or $0.88 per share (previously $0.60). Our speculative value stands at A$2,004m or $1.32 per share (previously $1.35) for the Expanded Case.