Nifty MRE Update: In May 2022, CYM released a significant update of the Nifty mineral resource estimate (MRE): 95.1 Mt @ 1.0% Cu for 940,200 t copper. Nifty is now the sixth largest development project in Australia, ranked by contained copper metal. It has also the highest grade. This report update focuses on the impact of the new MRE on the Sulphide Project.

Oxide then Sulphide: The oxide SX-EW project, for which CYM released a Restart Study on 11 March 2022 is the first stepping stone in terms of copper production from 2023 (average production of 25,000 tpa copper cathode over six years). The cash flow generated can finance the refurbishment of the sulphide concentrator and the restart of the copper concentrate production to extend the mine life (average of 23,000 tpa of payable copper in concentrate over 19 years) assumed to start in 2029.

Copper Projects Portfolio: Beyond Nifty, CYM owns 100%* of the Maroochydore copper project with a mineral of 48.6 million tonnes at 1.0% Cu for 486,000 tonnes of copper contained as well as the Murchison copper project, including the Hollandaire mineral resource of 2.8mt @ 1.9% Cu for 51,500t copper, 28,000oz gold and 500,000oz silver. Both projects are development opportunities in line with CYM’s management expertise.

Board & Management: CYM is looking to leverage the collective experience in building and very successfully operating a sulphide copper heap leach project in remote Indonesia and other base metals projects in Australia. This sulphide heap leach project provided unique knowledge and capability of the correct methodology required to produce low cost/premium value copper metal on site, which is then directly saleable into the global metal market.

Copper market: The outlook is excellent for the next few years with deficits forecast from most years and a step change in pricing from US$6,560/t or $3/lb (2006-2020 average) to $9,280/t or $4.20/lb (2021-2026F average).

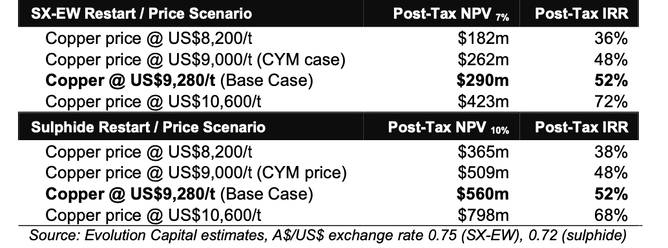

Nifty Valuation: We have first modelled the Nifty project in line with the Restart Study parameters to check the model’s validity, then run three different copper price scenarios including a slightly higher copper price for the Base Case at $9,280/t compared to $9,000/t for the Restart Study. The Sulphide Restart is based on the Scoping Study results released by Metals X Ltd (ASX: MLX) in June 2020 with increased capex and opex and increased mining inventory in light of the update MRE released by CYM in May 2022

News flow: Beyond the key catalyst of debt project financing for the Nifty restart ($200 million assumed in the form of senior and subordinated debt, and off-take financing), we can expect more good exploration results from the Maroochydore and Murchison projects, including some high grade copper intercepts, and updated mineral resource estimates.

Other Projects: Once Nifty has restarted, CYM has the opportunity to accelerate the evaluation of the Maroochydore and Murchison projects, adding significant value while the exploration expenditure is self-financed.

CYM Valuation: Considering the above parameters, our Base Case valuation increased slightly to $470 million (from $446m) or $0.63 per share.