TER has pulled a significant turnaround story from its acquisition of the Blair Athol complex and its takeover of Universal Coal. The company has transformed from cash strapped and heavily in debt to effectively “printing money” and making significant inroads towards repaying its outstanding debt.

In addition to the excellent operational performance of TER and the management team, two key factors have acted in the company’s favour: 1. Exceptional mining performance in its key assets and 2. Rising energy / thermal coal prices, which have translated into significant cashflow even with negative sentiment in the sector due to ESG concerns.

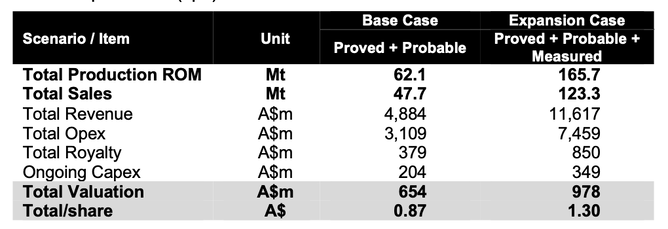

We have two key production scenarios under various pricing and cost assumptions being: 1. Production of its Proved and Probable Reserves (Base Case) and 2. Being production of its Proved + Probable Reserves + Measured Resources (Expansion Case). We include in both scenarios the upside value from its additional acreage.

Recently the company announced a US$60m coal sales prepayment facility to refinance the outstanding Euroclear bond, which is based on a 600,000 tonne coal sales offtake agreement with pricing based on and linked to the API4 index at time of delivery, and delivery to occur during the period 1 June 2022 to 31 May 2023. Currently this transaction is still subject to the usual Conditions Precedent (‘CP’s’). If the deal is successful we anticipate this adds ~3 cents per share (cps) to our valuation.

2021 was a watershed year for TER with a strong management team, capitalised balance sheet, enhancing and steadying production, reduced costs and renegotiated debt. 2022 represents the year that TER will reap the benefits of all of its hard work and be able to provide the market with extensive and consistent positive news flow which have already begun to be reflected in the share price, up over 50% since the beginning of 2022.

Currently our risked Base Case valuation comes to $654m or A$0.87/share while for our Expansion Case the NPV amounts to A$978m or A$1.30/share. Our price target for TER comes to A$1.30/share, representing a 3.0x uplift to its recent close price. It is based on the Expansion Case, which is self-funded by the strong cash flow generated from the Base Case and onwards.