World Class Asset: Within polymetallic deposits, volcanic massive sulphides or VMS typically present the best grades, but can be limited in size. The proposed Kudz Ze Kayah project in Yukon has both the size (15.7 Mt ore reserve) and a valuable combination of base and precious metal grades (Zn, Cu, Pb, Ag, Au) to stand out among its peers.

Feasibility Study: BMC (UK) Ltd through its subsidiary BMC Minerals (No.1) Ltd, has released the results of a Definitive Feasibility Study in July 2019 at the proposed Kudz Ze Kayah mine.

Mining Development: While most VMS deposits are typically mined underground, the Kudz Ze Kayah mineral resource is close to surface and mostly amenable to open pit mining (ore reserve of 14.0 Mt out of 15.7 Mt total). Processing: Ore processing will follow a conventional crush, grind and float producing three concentrates, zinc, lead and copper with substantial gold and silver by-product credits.

Costs: size, grade and mining method translate into highly competitive capital cost (US$387m), capital intensity and operating costs (first quartile on the zinc cost curve).

Board and management have extensive mineral industry experience with a track record of successfully financing, permitting, building and operating similar projects: e.g. the Jaguar copper-zinc mine in Western Australia.

Funding: BMC is well funded with the support of its existing shareholders. Mining banks and other financial institutions have initiated discussions about project financing.

Permitting: the next step in progressing the project is the completion of the environmental and regulatory approvals over the next 18 months, while working in parallel on detailed engineering and negotiating a funding package with mining banks and other financial institutions.

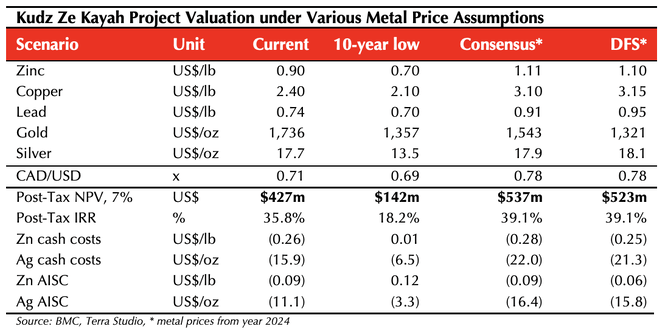

Valuation: Three price scenarios have been considered as detailed below. The 10-year cycle low scenario demonstrates the robustness of the project and the Consensus scenario validates the results of the DFS.

Upside: The KZK project is within the Finlayson Lake District where numerous VMS occurrences and six deposits have been discovered so far. The six deposits discovered in the district to date, ABM, GP4F, Kona, Ice, Wolf and Wolverine, collectively contain in excess of 40 Mt of base metal mineralization.

IDAWINNiobiumCDTVanadiumFluoriteTVNMXRANXRutileSVMTSOAQCGBRFRBILTBTRA11INFTORMAYBauxiteLINZirconLimeMRLASOAZLIron oreMGTAmmoniaPhosphateMNBBatteriesGraphiteMNSESSDRMAQICYMAGYCoalTERRare earthsIndiumAW1NIMAZSUraniumSandSilicaVRXSUVPECMLMDRXASQMolybdenumDEXCE1Oil&GasFlashSGQSVYReportADDIXRCXOAOUNCMNVAMEPHalloysiteKaolinREEHPAPM1ProfileMediaBMCZincLeadManganesePGECobaltGoldCopperLKERCGRLEMYLPSCARLXAMNickelSilverCTMBSXLithiumGMCG88COVID-19CZNNZC

TAGS

Asset & Management Quality Warrants Development Financing

May 25, 2020