Massive Mineral Resource: the Razorback Iron Ore Project combines a globally significant mineral resource with enviable characteristics: 6.0 billion tonnes inclusive of Ironback Hill and Muster Dam with low deleterious elements (silica, alumina and phosphorus).

Ore Reserve: based on the Razorback and Iron Peak deposits, the Ore Reserve has been updated to 2 billion tonnes. Overall, this massive ore reserve translates to a mine life in excess of 90 years (5 Mtpa product capacity Base Case) or 39 years (Expansion Option 10 Mtpa from year 5).

Competitive Advantage: From a steel manufacturing perspective, MGT’s magnetite is a high-grade product with grade of 67.5-68.5% Fe and low impurities highly sought after by steelmakers to increase productivity, provide efficiencies and reduce emissions.

Development Options: given the increased mineral resource in terms of both size (6.0 billion tonnes and growing) and quality (DR grade), the optimisation study released on 20th March 2023 considered an initial 5 Mtpa concentrate production, increasing to 10 Mtpa a few years later (versus a previously envisaged 3 Mtpa to 7 Mtpa development scenario).

Government Support: the Razorback project fits well with the State Government’s vision of becoming a leading global supplier of quality magnetite products for steelmaking. It is also worth noting that the financial contribution (royalties, corporate taxes, payroll taxes, excise duties, income taxes) from the project will be outstanding, estimated by a recent analysis report from BDO at $31 billion over 30 years including $1.6 billion for the South Australian Government and $3.8 billion for the Australian Government.

Green Steel: as the expectation of cleaner, greener steel production becomes further embedded in the global narrative, MGT magnetite products offer a viable alternative to Direct Shipping Ores (DSO), for which most of the high-grade deposits are now significantly depleted. Its production will also be assisted by renewable energy making it even greener and more competitive.

Strategic Investors: a number of parties have been given access to a data room to undertake their due diligence of the Razorback project. One can expect some agreement with one or more of them during 2023.

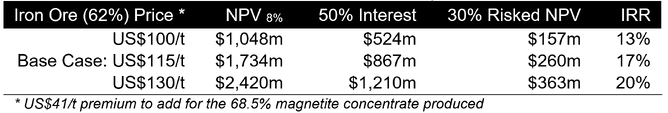

Razorback Financial Modelling: we modelled the development and operation of the project in line with Base Case (5 Mtpa) and Expansion Option (5 to 10 Mtpa), then used different iron ore prices.

Razorback Valuation: based on various iron ore prices:

Funding: to assist the funding of initial A$1,540-1,882 million development capital expenditure (Base Case 5 Mtpa), we assumed that MGT will sell 50% of the Razorback project to one or more off-takers with proceeds of $100m.

Key Share Price Catalysts: securing and de-risking critical infrastructure such as water supply and port capacity as well as progressing the development studies towards a Definitive Feasibility Study (DFS) should intensify the discussion with off-takers and project partners leading to project development pathways and funding, which will significantly de-risk the project and improve MGT’s value further.

MGT Valuation: assuming an equity capital raising of A$100m (100 million shares @ $1.00) in FY2025 to complement an initial debt of A$300m, we derived a valuation pre-construction of $663m or $2.90 per share. Expansion will be financed by cash flow and additional debt. Once in operation, the project should reach its full valuation resulting in a price of $4.50.